SEI Price Prediction 2025-2050: Is SEI a Good Investment?

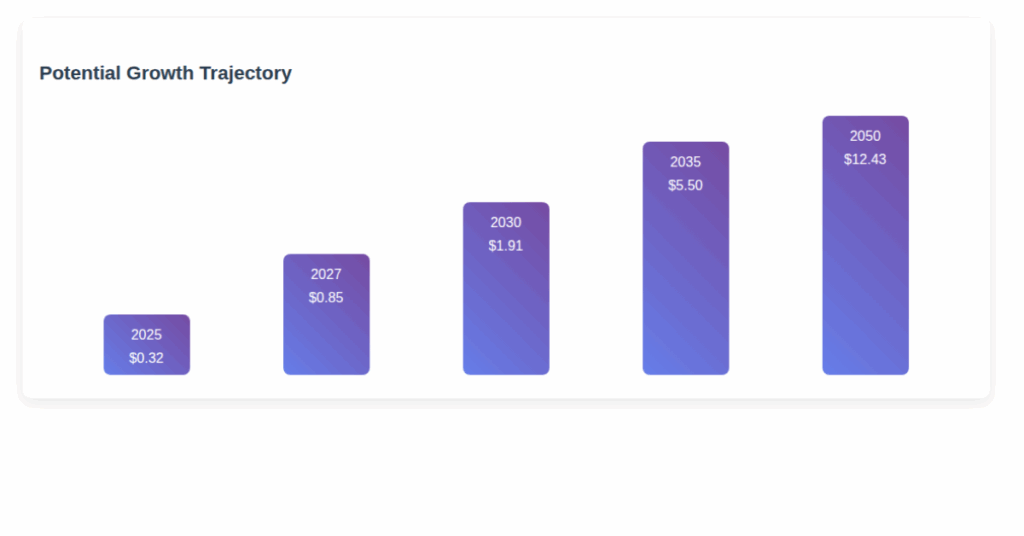

Quick Summary: SEI is a high-performance Layer 1 blockchain designed specifically for trading applications. With current predictions ranging from conservative estimates of $0.32 by 2025 to bullish projections of $12.43 within the next decade, SEI presents both opportunities and risks for investors. This comprehensive analysis explores whether SEI crypto could be your next winning investment.

What is SEI Cryptocurrency?

SEI is not just another crypto token – it’s the native cryptocurrency of the Sei Network, a revolutionary Layer 1 blockchain built from the ground up for trading applications. Think of it as the “Formula 1” of blockchains, designed for speed and precision in financial transactions.

The Sei blockchain stands out with its unique architecture that includes parallel transaction processing, a native order matching engine, and what they call “Twin Turbo consensus.” These features enable sub-400ms finality while maintaining the security standards that crypto users expect.

Key Features That Make SEI Special

- Lightning-fast transactions: Processes thousands of transactions per second

- Built-in order matching: Native DEX functionality without smart contracts

- EVM compatibility: Works with existing Ethereum tools and applications

- Institutional backing: Supported by Coinbase, Multicoin Capital, and other major players

SEI Price Prediction 2025: What the Experts Say

SEI Price Predictions Overview

| Source | 2025 Prediction | Methodology |

|---|---|---|

| Changelly | $0.224 – $0.257 | Technical Analysis |

| Kraken | $0.32 | 5% Growth Rate Model |

| CoinDCX | $0.36 | On-chain + Developer Activity |

The SEI price prediction for 2025 shows a generally optimistic outlook among analysts. According to technical analysis, the minimum cost of SEI in 2025 is expected to be $0.224, with a maximum level reaching $0.257. However, other sources are more bullish, with CoinDCX predicting a 15-20% rally toward $0.36, backed by rising developer activity, MetaMask integration, and solid on-chain growth.

Long-term SEI Crypto Forecast: 2030 and Beyond

SEI Price Prediction 2030

Looking at the longer timeline, SEI’s future price potential becomes even more intriguing. Forecasts suggest SEI could reach $1.908 by 2030, representing significant growth from current levels. This projection is based on the expectation that SEI’s trading-focused blockchain will capture a larger market share as DeFi continues to mature.

The Road to 2050: SEI Long-term Outlook

While 2050 predictions should be taken with a grain of salt, some algorithmic models paint an incredibly bullish picture. Certain prediction systems suggest that SEI’s price may exceed its all-time high of $1.03 and reach as high as $12.43 within the next ten years.

*Hypothetical projection based on various analyst predictions

Is SEI a Good Investment? Analyzing the Fundamentals

The Bull Case for SEI

Several factors support a positive investment thesis for SEI:

Pros

- Unique Value Proposition: First blockchain specifically optimized for trading

- Strong Growth Metrics: Over 1000% growth in total value locked, from $61 million to $626 million in six months

- Institutional Support: Backed by world-class operators like Coinbase, Delphi Digital, and HRT

- Technical Innovation: Sub-400ms finality with parallel processing

- Ecosystem Funding: Secured $70 million in ecosystem funding in just eight months

Cons

- Market Competition: Faces competition from established Layer 1s like Ethereum and Solana

- Regulatory Uncertainty: DeFi regulations could impact growth

- Technology Risk: New blockchain technologies may face unforeseen technical challenges

- Market Volatility: Crypto markets remain highly volatile and unpredictable

- Adoption Risk: Success depends on widespread developer and user adoption

Read More:-What is Impermanent Loss? How It Works, and How to Avoid It

Real-World Crypto Investment Psychology

When considering SEI as an investment, remember the golden rules that have helped successful crypto investors:

Example from Crypto History: Early Solana investors who recognized its speed advantages saw 1000x+ returns. Similarly, those who identified Polygon’s scaling solutions early were rewarded handsomely. SEI’s trading-focused approach could follow a similar trajectory if it captures market share from traditional DEXs.

Practical Investment Tips for SEI:

- Dollar-Cost Average (DCA): Instead of buying all at once, spread your purchases over 6-12 months

- Position Sizing: Never invest more than 5-10% of your crypto portfolio in any single altcoin

- Timeline Matters: SEI is likely a 2-5 year play, not a get-rich-quick scheme

- Monitor Development: Watch for ecosystem growth, partnerships, and TVL increases

SEI Investment Risk Analysis

Market Factors Affecting SEI Future Price

Several key factors will influence whether SEI reaches its predicted price targets:

Positive Catalysts:

- Increased adoption by DeFi platforms seeking faster trading infrastructure

- Integration with major exchanges and wallets (like the recent MetaMask integration)

- Bull market conditions in crypto generally

- Successful ecosystem projects driving SEI token demand

Risk Factors:

- Competition from other high-speed blockchains

- Regulatory crackdowns on DeFi trading

- Technical issues or security vulnerabilities

- General crypto market downturns

Read More:-What Is Volatility and How Do You Handle It in Crypto?

SEI Investment Strategy Framework

Conservative Approach: Allocate 2-3% of your total crypto portfolio to SEI, with a 3-5 year holding period.

Aggressive Approach: Up to 10% allocation for investors who believe strongly in the trading-focused blockchain thesis.

Speculative Approach: Higher allocations only for experienced traders who can handle significant volatility.

Frequently Asked Questions (FAQ)

What makes SEI different from other cryptocurrencies?

SEI is the first blockchain specifically designed for trading applications, featuring parallel processing, native order matching, and sub-400ms finality. Unlike general-purpose blockchains, SEI optimizes every component for trading efficiency.

Can SEI reach $10 by 2030?

While some algorithmic models suggest SEI could reach $12.43+ within a decade, such predictions are highly speculative. A more realistic target based on current analysis would be the $1.90-$5.00 range by 2030, depending on ecosystem growth and market conditions.

Is SEI crypto a good long-term investment?

SEI shows promise as a long-term investment due to its unique trading focus, strong institutional backing, and growing ecosystem. However, like all cryptocurrencies, it carries significant risks including market volatility, competition, and regulatory uncertainty.

What are the main risks of investing in SEI?

Key risks include intense competition from other Layer 1 blockchains, potential regulatory restrictions on DeFi trading, technical vulnerabilities, and general crypto market volatility. New blockchain projects also face adoption challenges.

How much should I invest in SEI cryptocurrency?

As with any cryptocurrency, never invest more than you can afford to lose. Conservative investors might allocate 2-5% of their crypto portfolio to SEI, while more aggressive investors might go up to 10%. Always diversify your investments.

When is the best time to buy SEI?

Rather than trying to time the market, consider dollar-cost averaging (DCA) your purchases over several months. This strategy helps reduce the impact of short-term price volatility and can lead to better average purchase prices.

Conclusion: SEI’s Investment Potential

SEI represents an intriguing investment opportunity in the evolving crypto landscape. Its focus on trading infrastructure, strong institutional backing, and impressive early growth metrics suggest genuine potential for long-term value creation.

The price predictions ranging from $0.32 in 2025 to potentially $12.43+ by the 2030s reflect both the opportunities and uncertainties inherent in crypto investing. While these projections should be viewed as educated estimates rather than guarantees, SEI’s unique value proposition in the trading space gives it a competitive edge.

For investors considering SEI, the key is balancing optimism with prudent risk management. The blockchain’s technical innovations and growing ecosystem provide legitimate reasons for bullishness, but the competitive crypto market demands careful position sizing and realistic expectations.

Important Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Cryptocurrency investments carry substantial risk, including potential total loss. Always conduct your own research, consider your risk tolerance, and consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

Ready to Research SEI Further?

Before making any investment decisions, take these next steps:

- Visit the official Sei Network website to understand the technology

- Follow SEI’s development progress on social media and GitHub

- Monitor ecosystem growth and TVL metrics

- Consider starting with a small position and scaling up based on performance

- Join SEI community discussions to gauge sentiment and developments

Remember: In crypto investing, knowledge and patience often outperform speculation and haste.